Business Development Companies (BDCs) are one of the best-kept secrets in the world of income investing.

They’re known for paying out big dividends, often 8–12% annually, and give investors exposure to private companies that aren’t publicly traded.

But how do they work? And what are the risks?

In this article, you’ll get a mini masterclass on how BDCs operate, what to look for, and an example of one of the most trusted BDCs on the market.

💼 What Is a BDC?

A Business Development Company is a publicly traded investment firm that lends money to middle market companies.

Here’s how it works:

The BDC raises money from investors (that’s you)

It lends that money out to private companies — usually ones too small for Wall Street

The interest income is paid back to the BDC, then passed along to shareholders as dividends

This setup allows BDCs to generate big-time yields, often paid monthly or quarterly.

Think of it as a way to become the bank… but with public stock liquidity.

📚 4 Key Things to Know About BDCs

1. They’re Required to Pay Out 90% of Income 🏦

Just like REITs, BDCs are legally required to distribute at least 90% of their taxable income to shareholders. That’s how they can offer such high yields. If Net Investment Income per share is > Dividend per share, the payout is likely sustainable.

2. They Benefit from Rising Rates (But Not Always) 📊

Many BDCs make floating-rate loans, which means higher interest rates can boost their income. But a weak economy or lower rates can hurt returns.

3. Dividends May Be Taxed as Ordinary Income 💸

Unless noted otherwise, BDC dividends are often taxed at ordinary income rates, not qualified dividend rates. (Translation: higher taxes if held in a regular brokerage account.)

4. They Lend to Smaller, Riskier Businesses ⚠️

BDCs typically finance private, lower-to-middle-market companies. These businesses often lack access to traditional capital markets, so they rely on BDCs for funding. As a result, the credit risk is higher, especially during economic downturns or recessions.

📈 Popular BDCs to Know

Here are some of the better-known names in the BDC space:

ARCC – Ares Capital Corp (9.2% yield)

MAIN – Main Street Capital (7.9% yield, monthly payout)

HTGC – Hercules Capital (10.9% yield, tech/startup focus)

FDUS – Fidus Investment Corp (12.3% yield)

These BDCs vary by strategy. Some focus on stable income, others target growth-stage businesses, and some pay monthly vs. quarterly.

🔎 Example: MAIN (Main Street Capital)

Let’s take a look at one of the gold standards in the BDC world:

📊 MAIN (Main Street Capital)

Dividend Yield: ~7.9%

Dividend Frequency: Monthly

Founded: 2007

Focus: Lower middle-market companies across the U.S.

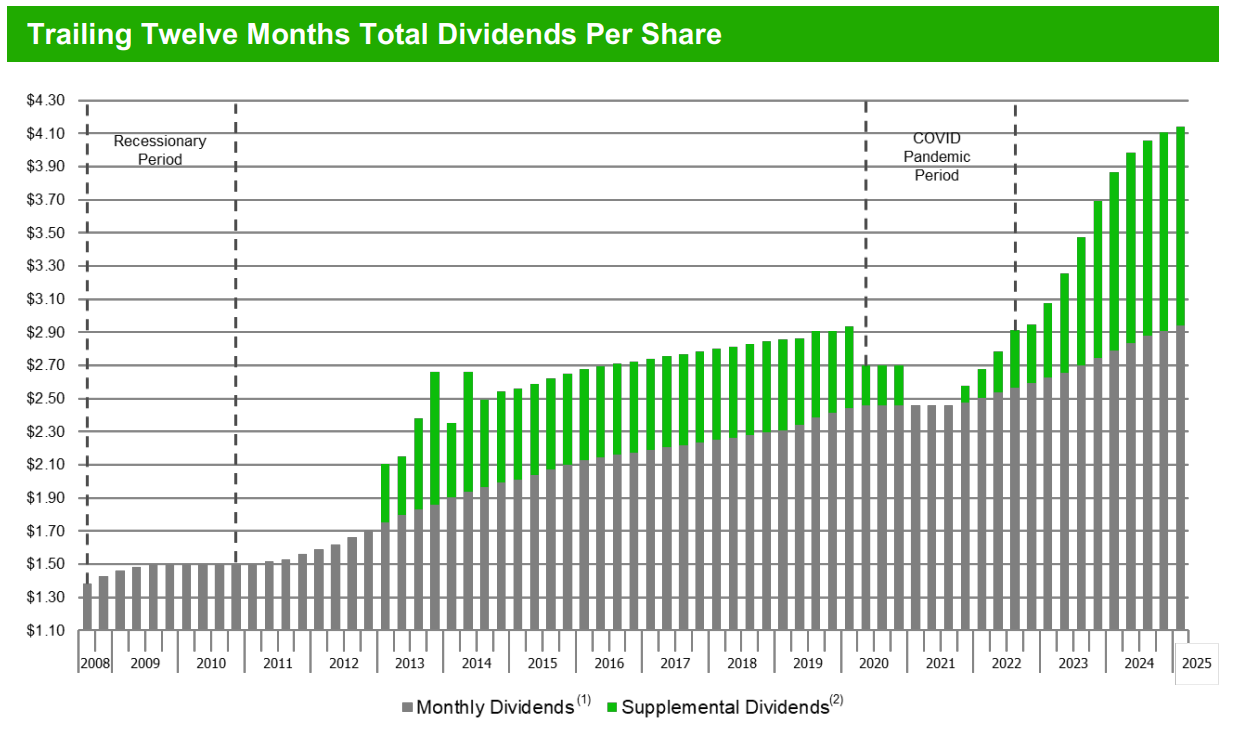

MAIN is known for its consistent payouts, strong management team, and even frequent special dividends.

Main Street Capital is internally managed, meaning employee and shareholder interests are aligned by linking compensation to performance (not asset size). This results in a lower cost structure than externally managed BDCs.

Unlike many peers, MAIN trades at a premium to NAV (Net Asset Value).

This is a sign of investor confidence in its long-term execution (But could also be a sign they trade at a premium).

If you’re looking for a BDC that blends steady income with a strong reputation, MAIN is a great place to start.

✅ Pros of BDCs

High Yields (8–12% is common)

Monthly or Quarterly Income

Exposure to Private Businesses (normally inaccessible to retail investors)

Potential Hedge Against Inflation/Rising Rates

⚠️ The Trade-Offs

Credit Risk: Small companies are more likely to default in a downturn

Tax Treatment: Many dividends taxed as ordinary income

Premiums to NAV: Buying at a premium can reduce future returns

Market Volatility: BDCs can sell off hard during economic scares

🤔 Should You Invest in BDCs?

Like all things in finance, it depends.

If you’re looking for reliable income and can stomach some added risk, BDCs might be a great addition to your income portfolio.

Just make sure you:

Understand how they generate income

Know if the dividend is sustainable

Consider tax implications

Remember, not all BDCs are created equal. There are plenty of bad BDCs out there.

As always: know your goals, understand the risks, and invest accordingly.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

I’m a big fan of BDCs myself.

Love it, love BDC’s.