The market can’t seem to make up its mind right now.

On one hand, we have stocks in my portfolio like Broadcom (who I’m up well over 200% on), climbing 13% after releasing their latest quarters earnings.

On the other hand, we have other stocks in the market getting hammered from the potential threat of tariffs.

Is this what CNBC would describe as a ‘Kangaroo Market’?

Regardless, it’s time like this where I’m thankful I’m a long term dividend growth investor.

Why?

2 Reasons:

My dividend income grows, regardless of market conditions

Volatility creates opportunity

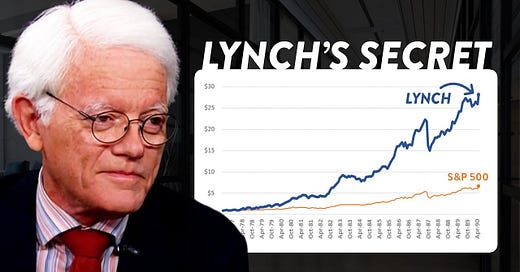

Peter Lynch was once asked if something should be done about the market volatility increasing.

To which he responded- “Well I love market volatility.”

I’m in the same boat as Peter Lynch.

I plan on being a net buyer on stocks over the long term.

My Portfolio 📝

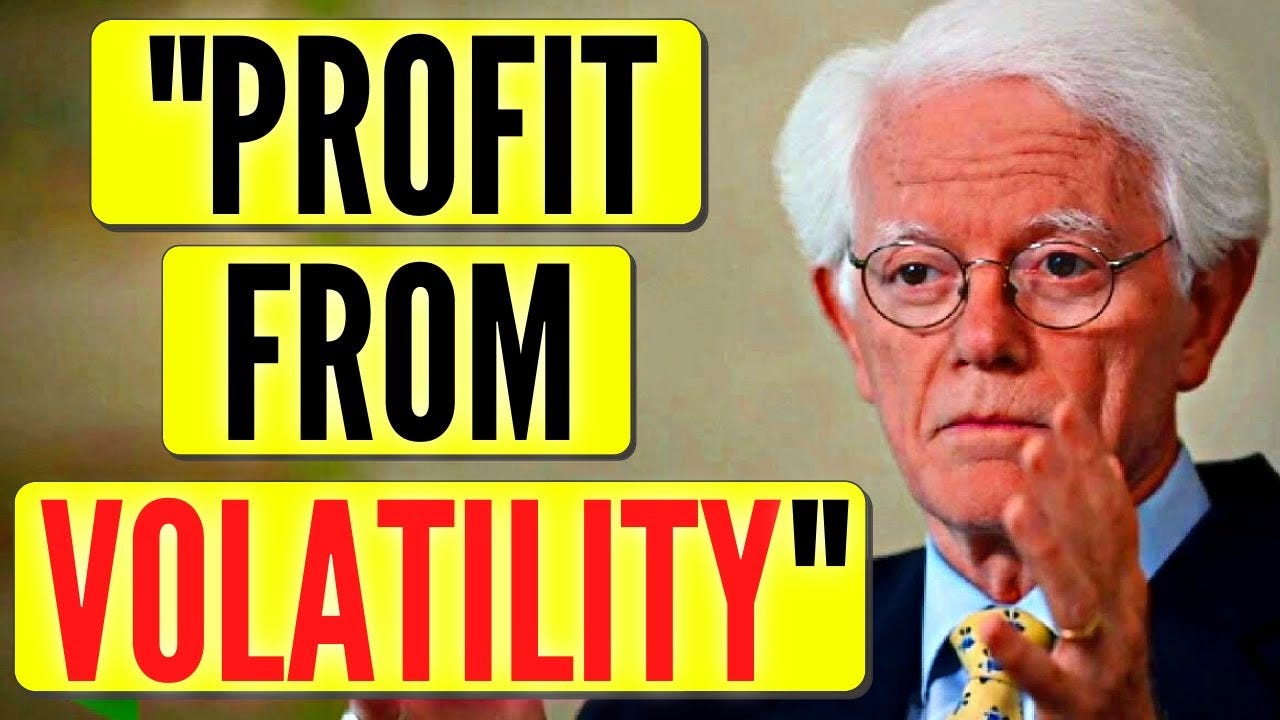

At one point in the past week, my portfolio was at an all time high of $218K.

It currently sits at $211K.

But you know what didn’t drop?

My annual dividend income.

It nevers does. (Unless I choose to sell a stock)

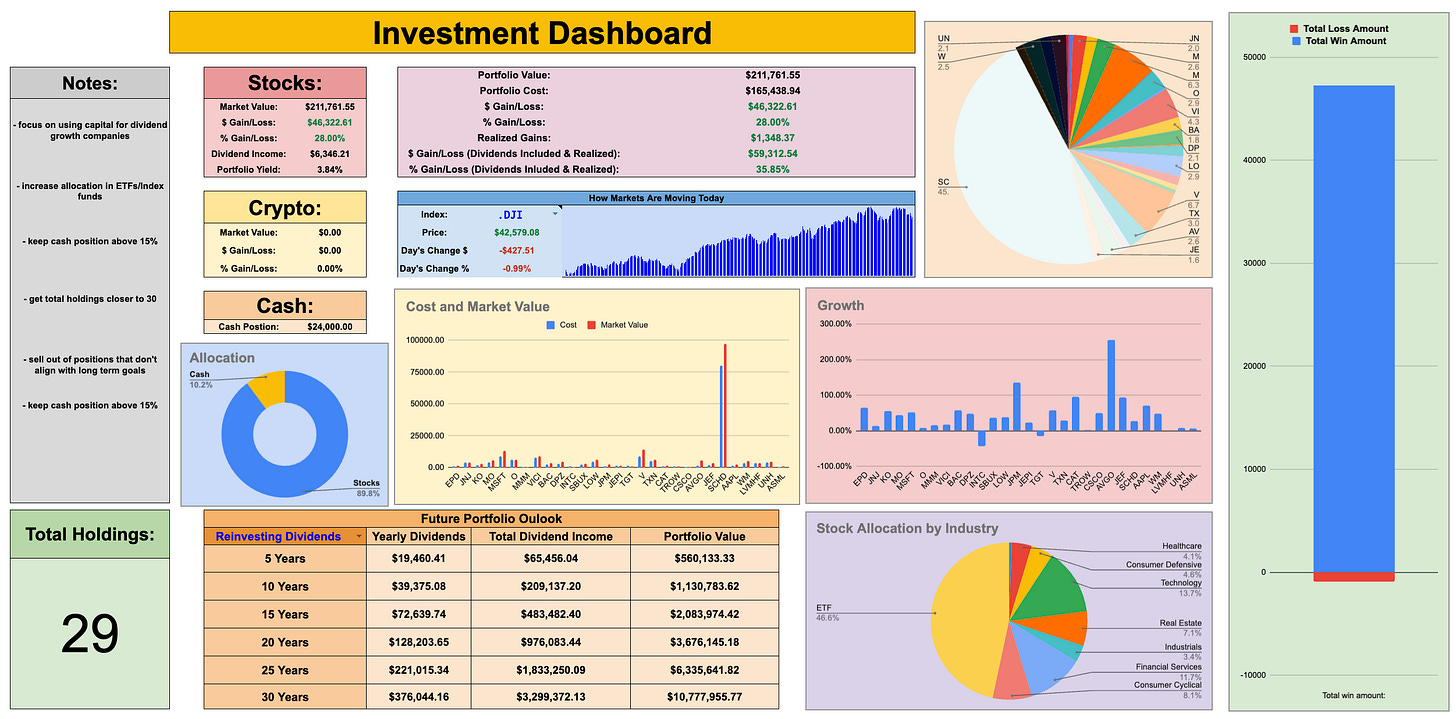

My projected dividend income over the years has grown rapidly:

Start of 2023: $1,945

Start of 2024: $4,956

Start of 2025: $6,300

And as of right now, it sits at $6,346.

This number climbs higher every month.

This is because I make monthly contributions, reinvest dividends, and buy stocks that grow their dividend payments every year.

For example, Dominos Pizza just announced a massive 15.2% dividend increase last month!

In the last month, I added shares to my SCHD position, as well as a share of UNH, who appears to be at an attractive valuation.

Other stocks, like MSFT and ASML (both of which I own in my portfolio) are also starting to become much more attractive options.

The great thing about stocks falling, is it gives me the opportunity not only to buy great stocks at good valuations-

But I can reinvest my dividend payments at lower prices, which buys me more shares…

Which you guessed it—This means I get paid more in dividend income.

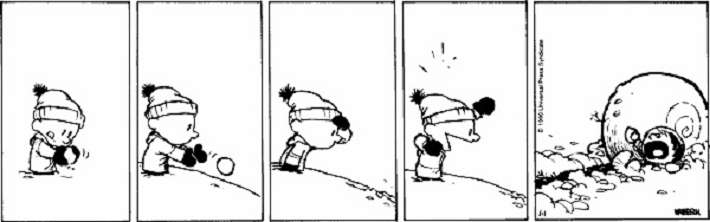

In reality, this speeds up the snowball effect.

So if the dividend snowball effect is what you’re after like I am, then nothing in the markets in the past month should bother you.

In fact, it should excite us.

The market is currently down -2.28% in 2025.

Sounds pretty exciting to me!

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

I love your charts. Nice work

Wondering which of your stocks you rate a buy for someone looking to start a new position?