One of the best kept secrets of the tax code in 2025?

The fact that under the right circumstances…

You could pay $0 in taxes on dividends.

To explain exactly how this is possible, I’m bringing on my CPA friend, “The Money Cruncher” to explain.

If you enjoy this breakdown, be sure to subscribe to his free newsletter!

Dividends are one of the most efficient investment returns.

Did you know that you can actually live off $126,700 of dividend income and pay $0 in federal taxes in 2025?

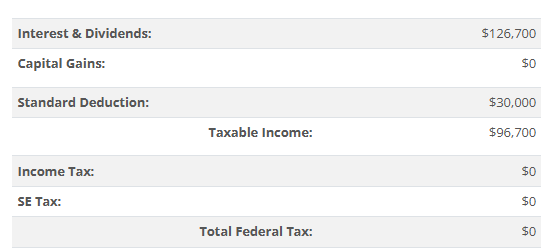

Here is a screenshot directly from a tax software:

Generating $126,700 of federal tax-free money is almost equivalent to generating a salary of $165,000.

In other words, you would need to earn $165,000 from your day job to have the exact same net pay of $126,700 with qualified dividends.

Remember, the tax code wasn’t designed for employees.

It was created for business owners and investors to help circulate the economy and get rewarded for the risk they take.

So, how does this actually work?

Qualified dividends get a preferential tax treatment.

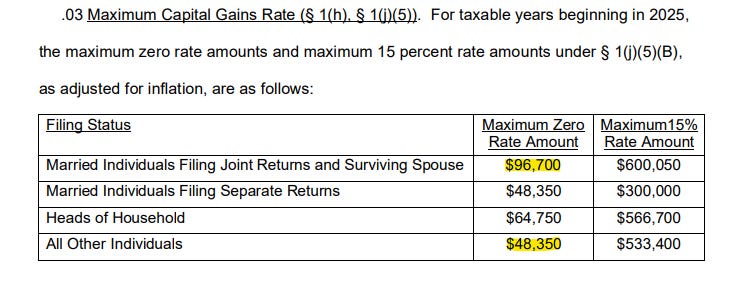

According to the IRS, if your taxable income is less than $96,700 and you file jointly, you will pay $0 in capital gains tax.

Link to the source - https://www.irs.gov/pub/irs-drop/rp-24-40.pdf

These numbers are based on the taxable income, which means that it’s after the standard deduction is applied.

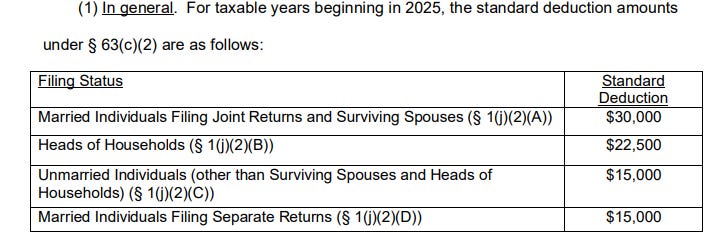

For 2025, these are the standard deduction amounts:

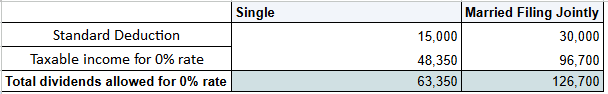

The standard deduction is $30,000 for married individuals, so here is how you can calculate the maximum amount you can generate in qualified dividends and pay $0 in federal taxes:

If you are filing as single, you can generate $63,350 of qualified dividends and pay $0 in federal taxes. That’s equivalent to almost an $85,000 salary!

The nice part about receiving dividends is that they are not subject to FICA taxes (Social security/medicare), unlike your W-2 wages are.

This is why they are also much more tax efficient than wages.

Now, this applies only to federal taxes.

You might still need to pay state taxes, unless you live in one of the following states:

Alaska

Florida

Nevada

South Dakota

Tennessee

Texas

Wyoming

These states don’t tax dividend income.

One concern many people have is “What about inflation? I can’t live off this amount forever!”

But, living off dividends can actually be quite sustainable even with inflation.

1. Tax brackets and deductions get adjusted with inflation

For example, the standard deduction in 2024 was $14,600 instead of $15,000.

The tax bracket went from $47,025 to $48,350.

So these numbers always get adjusted with inflation.

However, it’s important to note that the future legislation might change the amounts/tax.

2. Selecting stocks/ETFs with a long record of annual dividend increases

The second way you can protect yourself against inflation is by selecting high quality stocks/ETFs.

For example, Broadcom’s average 5Y dividend growth rate is above 14%.

That’s a lot higher than the annual inflation rate.

Along with tax brackets inflation adjustment, you will outpace inflation easily with quality dividend growth stocks.

What if I have other income types?

Even if you have other income types, such as wages, Required Minimum Distributions (RMDs) from retirement accounts, or Social Security income/pension, as long as your taxable income is below the thresholds, your qualified dividends will be taxed at 0%.

What if I earn even more dividends?

The nice part is that only the amount above the threshold is taxed at the next rate of 15%.

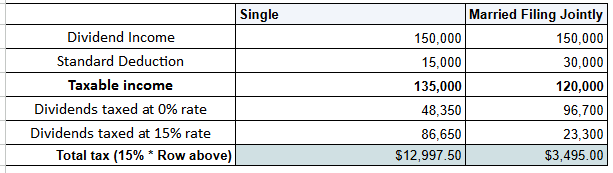

Say you generated $150,000 of qualified dividends, here’s how it would look:

So, if you are single, you would pay a 8.6% effective tax rate, or 2.3% if married.

You would’ve paid 24% federal tax rate + FICA taxes of 7% on a $150,000 salary!

The tax code can heavily favor dividend investors.

Quick note: In order for your dividend to be qualified, it must be paid by a U.S. company (or qualified foreign company) and you must hold the stock/ETF for at least 61 days during the 121-day period.

In Case You Missed It…

To celebrate Valentine’s Day, Tickerdata is offering 30% off the Premium Annual Plan (already 17% cheaper than paying monthly) with code “LOVE” at checkout!

Plus, you’ll unlock the full library of ready-to-use premium sheets.

This offer expires in 3 days.

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Key point is "qualified" dividends... vs "non-qualified".

This is why the rich play a different game.

The tax code clearly rewards investors over employees.