Portfolio Update

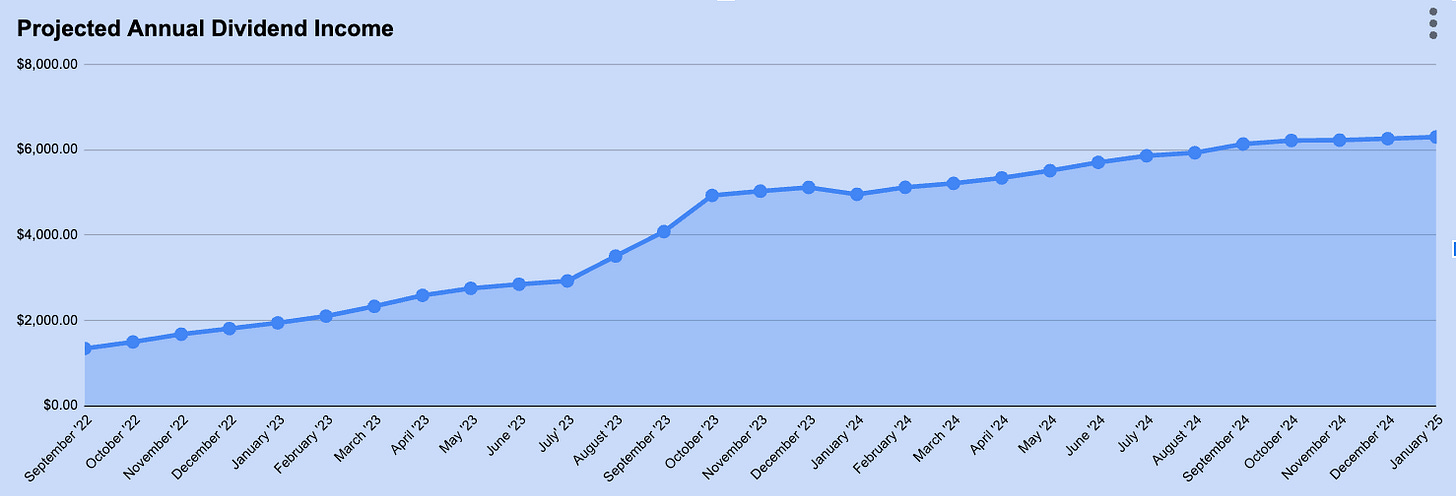

In 2024, I made a grand total of $5,937.34 in dividend income.

One of the ways I like to analyze my dividend income is by considering how long it could cover my living expenses.

$5,937 in dividends could cover my living expenses for a little over 1.5 months of the year.

That’s 1.5 months of freedom every year.

But here’s something else to take into account—

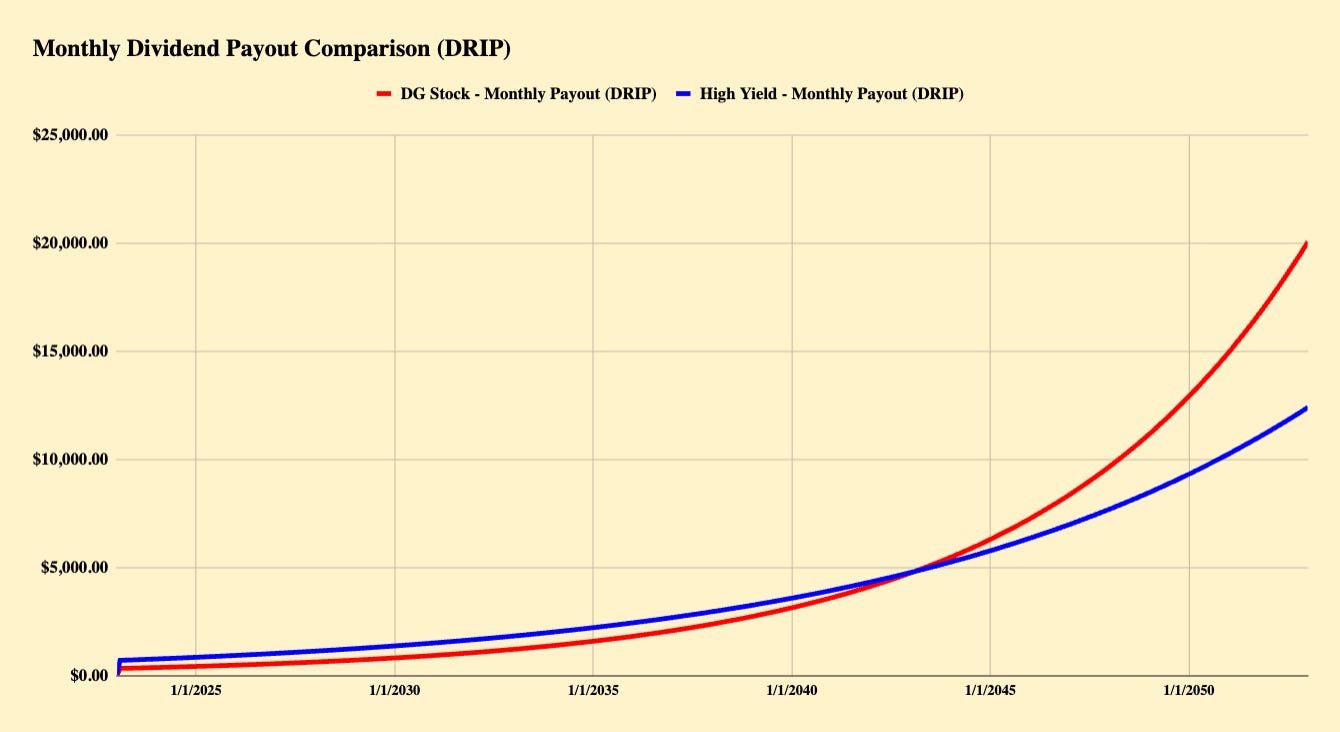

My current focus is on buying dividend growth stocks.

These are stocks that don’t typically have high starting yields but increase their dividend payouts every single year.

Why do I do this?

Because over the long term, dividend growth stocks will pay more in dividends (even if I reinvest dividends).

But let’s pretend for a moment that I wanted to start using my portfolio to help cover my living expenses.

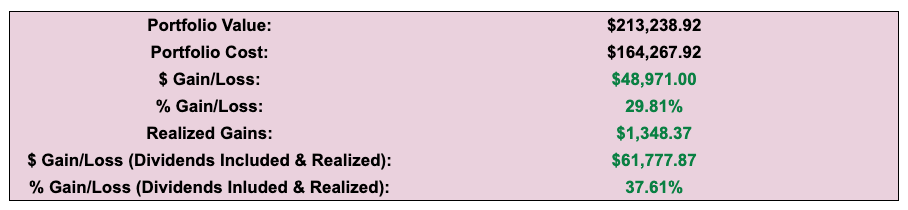

The current value of my portfolio is $213K.

If I wanted to maximize my dividend income right now and put my entire portfolio into high-yield stocks…

I could be generating around $16,000 a year or $1,333 a month in dividends (assuming a yield of 7.5%).

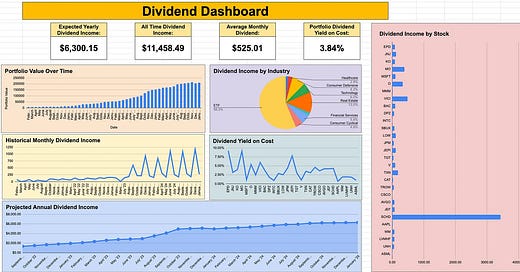

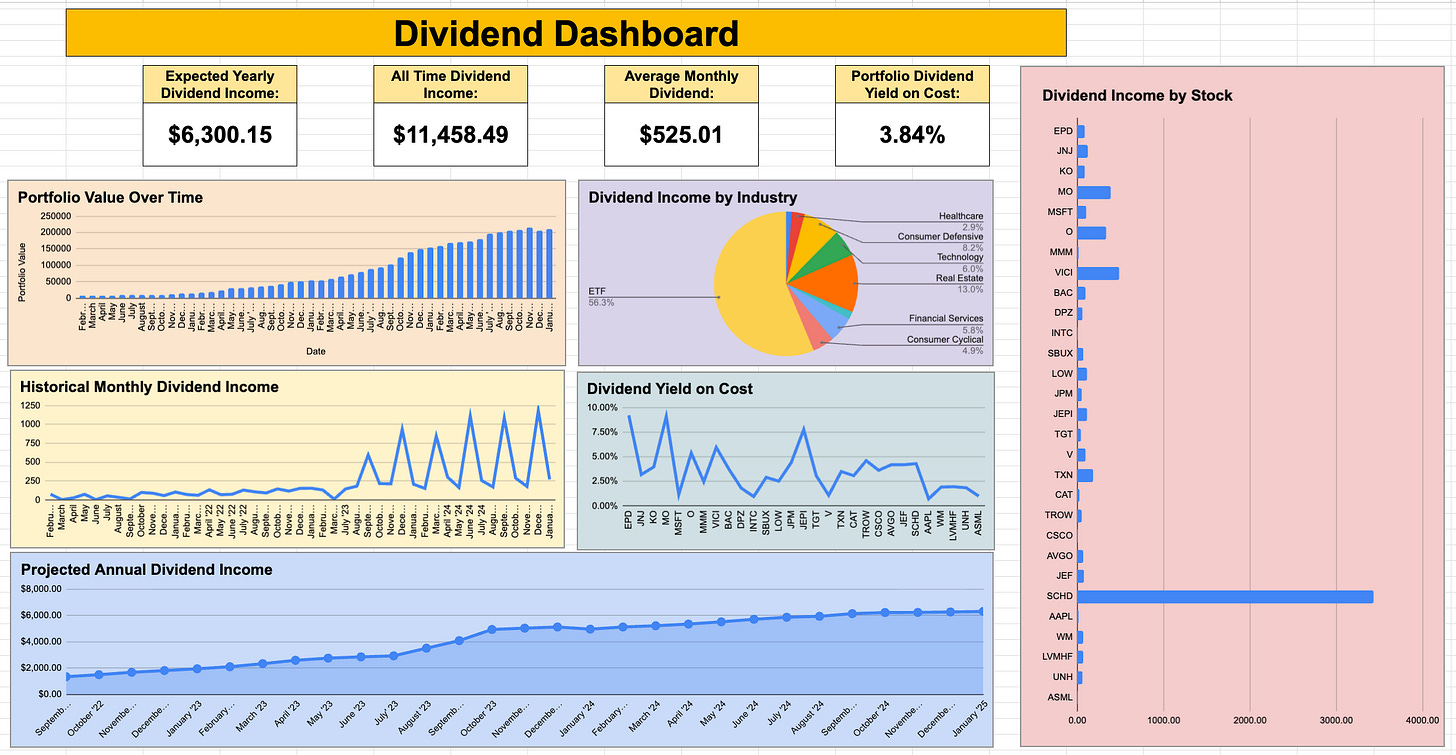

Currently, my portfolio generates $525 a month in dividends.

But I must say—it’s comforting to know that my portfolio could generate $1,333 a month if I wanted it to.

For now, though, I’ll stay focused on maximizing my long-term dividend income by buying dividend growth stocks.

January Update

In January, I received $271.14 in dividend income.

And while my portfolio value has fluctuated over the past few months due to market volatility, my projected annual dividend income continues to increase every month.

My annual dividend income now sits at $6,300!

In January, I did something I hadn’t done in a long time—

I added a new stock to my portfolio.

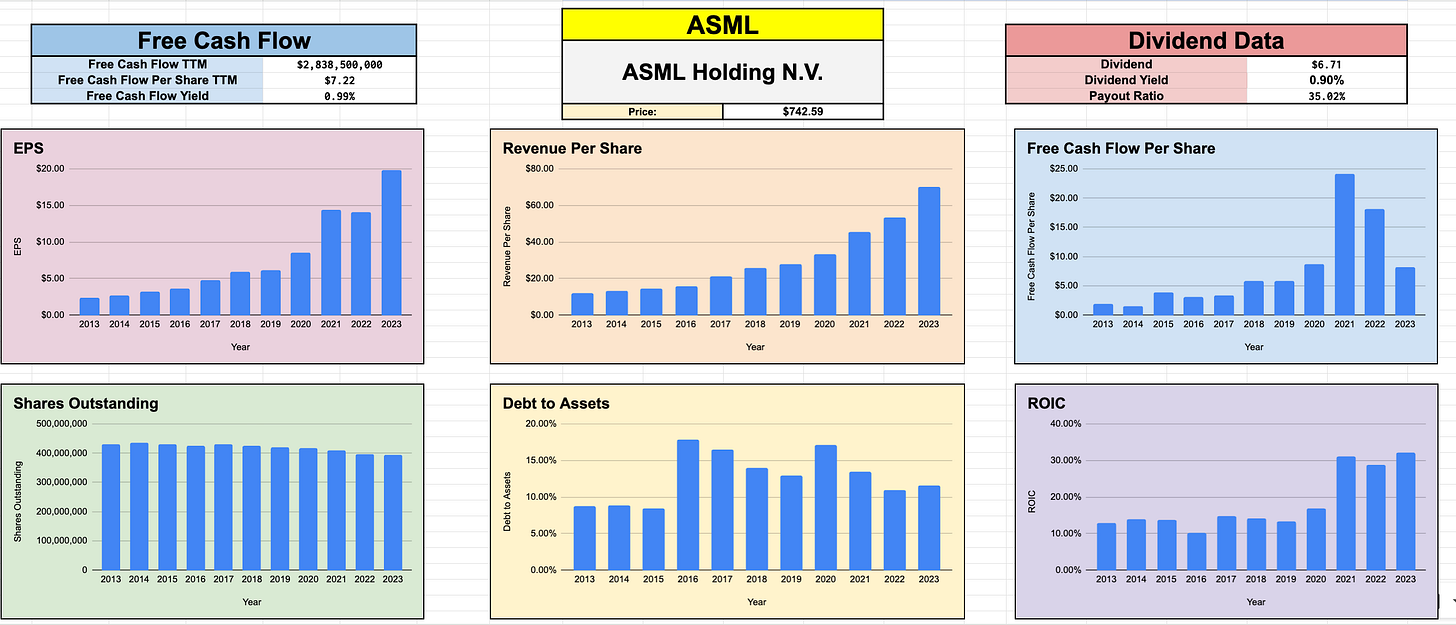

I bought ASML Holding.

This company is down over 17% in the past year and is projected to grow earnings at above 20% annually for the next three years!

Along with this, management stated in their recent earnings report that they intend to reward shareholders with a growing dividend moving forward.

There will likely be a lot of volatility with this stock in the coming years.

So if you're interested in this stock, make sure you have the stomach to handle market swings.

My Goals for 2025 Remain Unchanged:

✅ Buy high-quality dividend growth companies

✅ Buy at good valuations

✅ Do nothing

As companies grow their free cash flow, they will, in turn, increase their dividend payments.

This is my path to one day living off dividends.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Congrats on a great result for 2024. And thanks for sharing such specific into. The exact amounts and totals. Really interesting to see.

Did you come to an intrinsic/fair value for ASML? I get around $760.