One of the most frequently cited investment quotes?

“Be fearful when others are greedy and greedy when others are fearful.”

We hear this quote tossed around often when markets are surging.

But how good are investors at abiding by this quote?

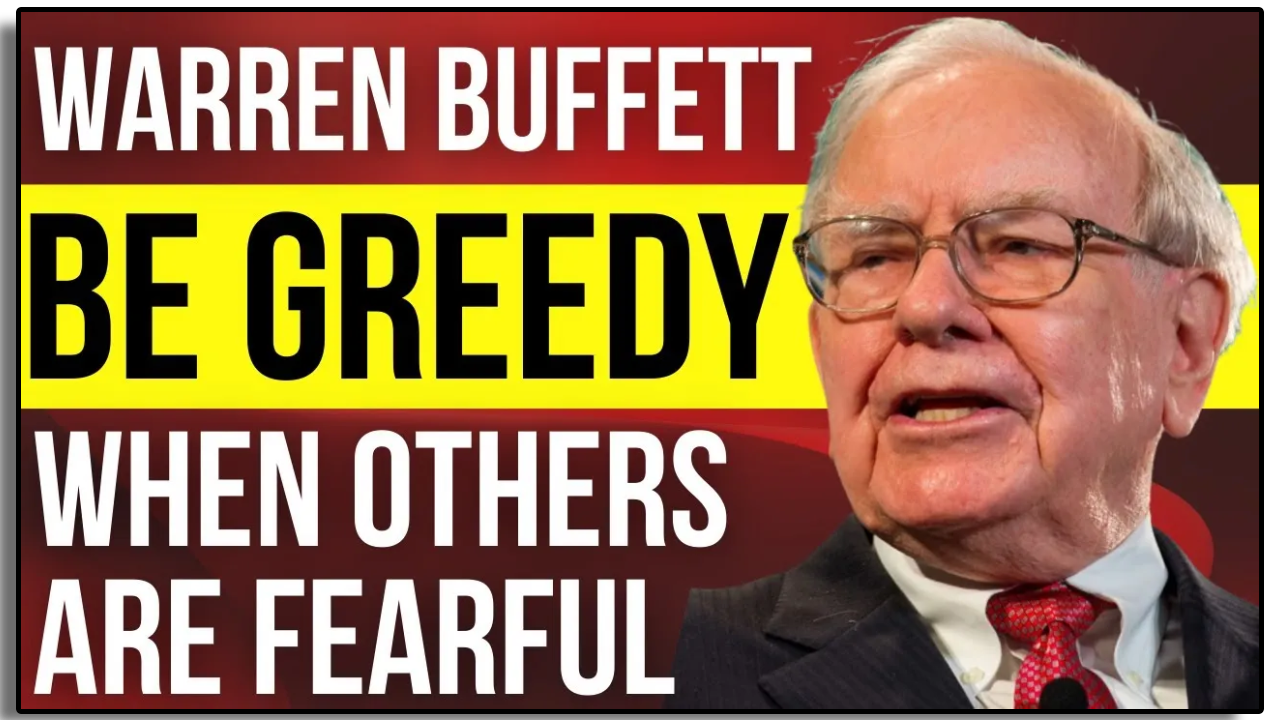

Goldman Sachs found that retail investors loaded up on stocks from 2019 to 2021 (when markets were climbing)-

But then sold basically all of their stocks after the market fell by -20% in 2022.

And this is the exact reason why most retail investors underperform the market.

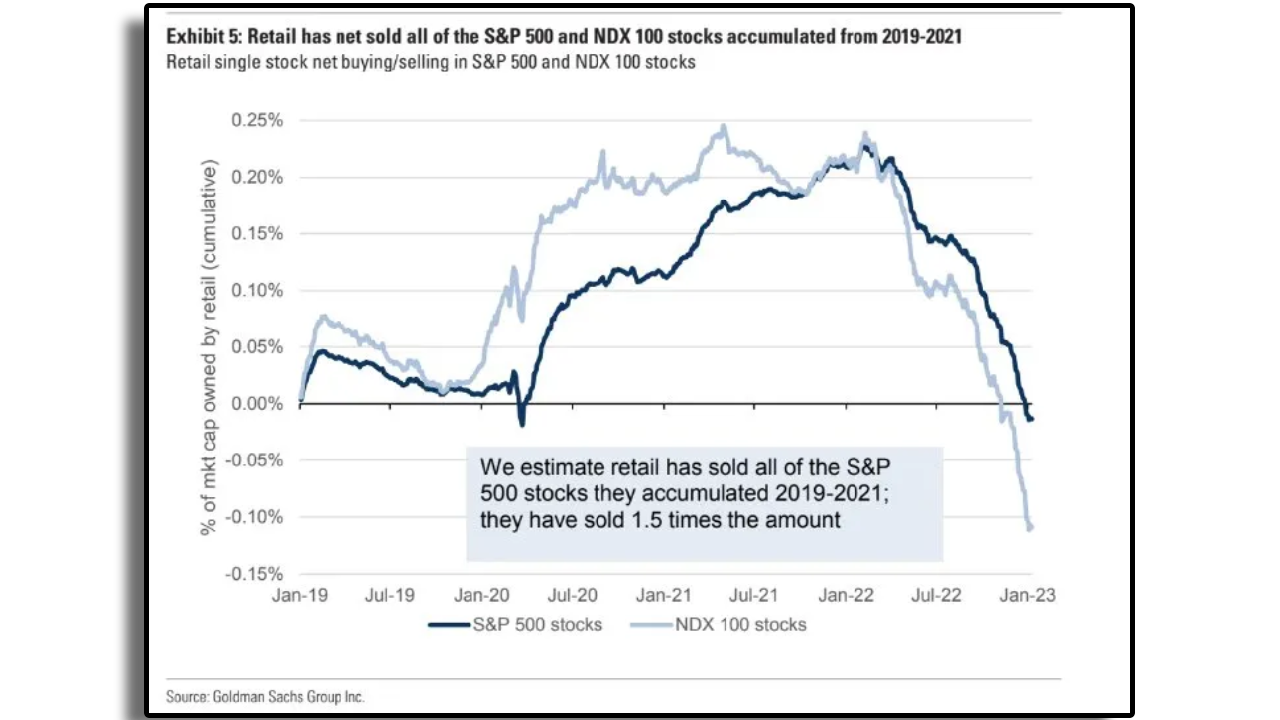

Why do I bring this up?

Not just because the market is down in 2025.

But because fear is growing.

Fear and greed are what drives market returns in the short term.

But in the long term, earnings and free cash flow growth are what drive market returns.

So what did I do this last month?

I did what I do every month.

I looked for opportunities to buy quality stocks at good valuations, that have the ability to grow free cash flow over the next decade, in turn, allowing them to grow their dividend payments.

My Portfolio 📝

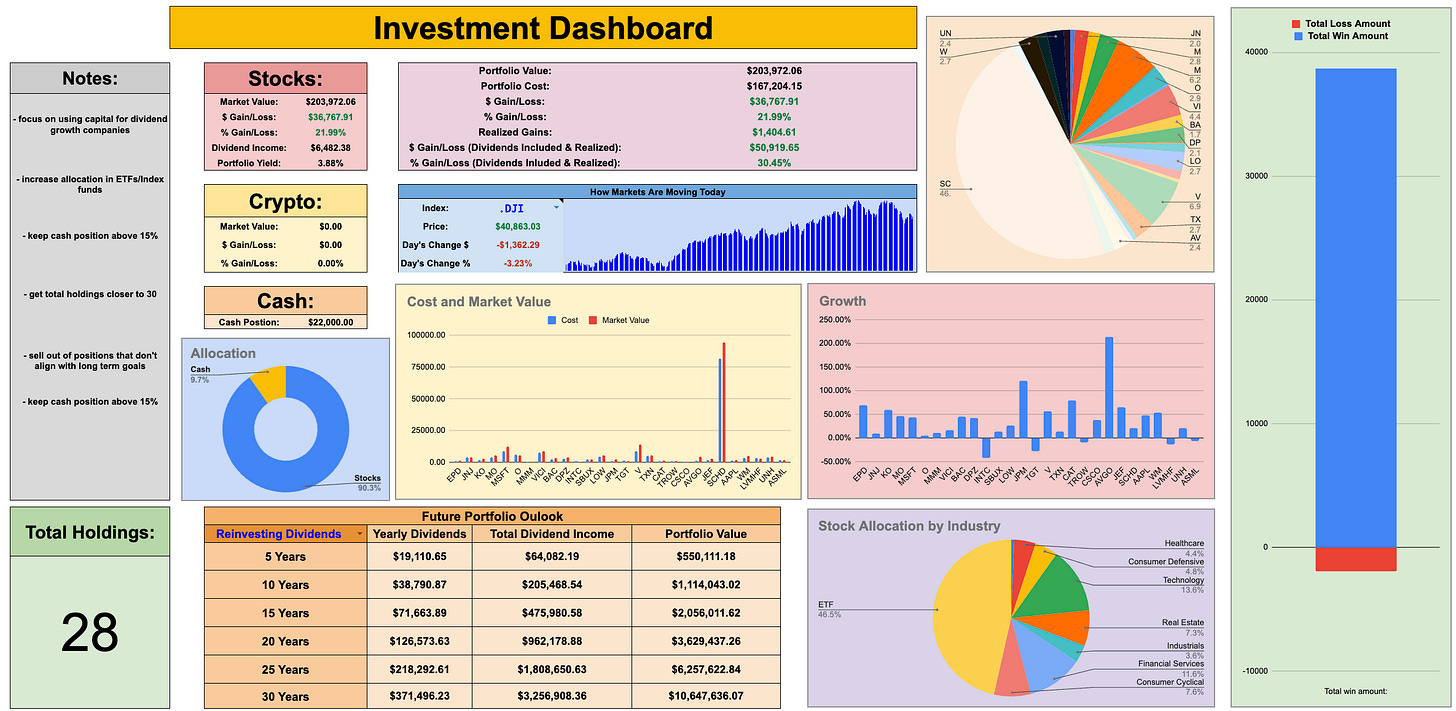

As of now, my portfolio is sitting at a value of around $204,000-

Which is close to a $12,000 drop from last month.

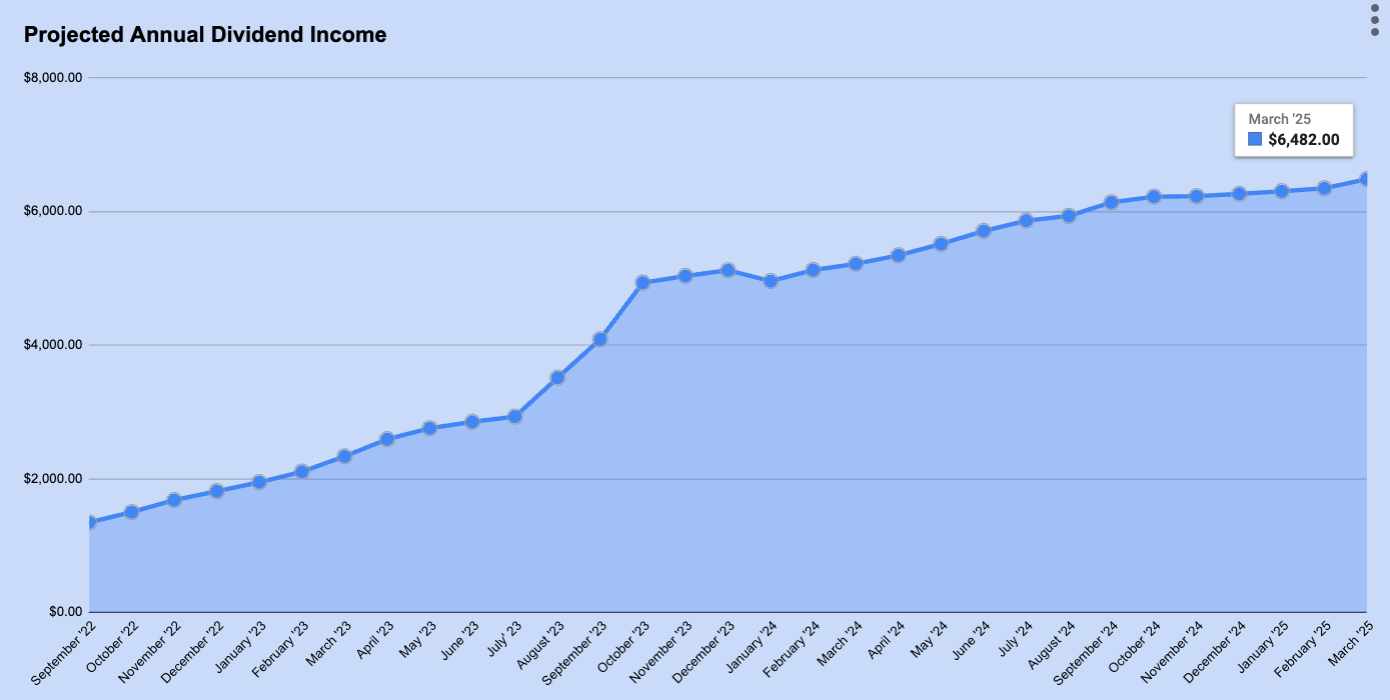

But like always, my projected annual dividend income climbed higher, just like it does every month.

My projected annual dividend income is now sitting at $6,482.

This puts my average monthly dividend income $540.20.

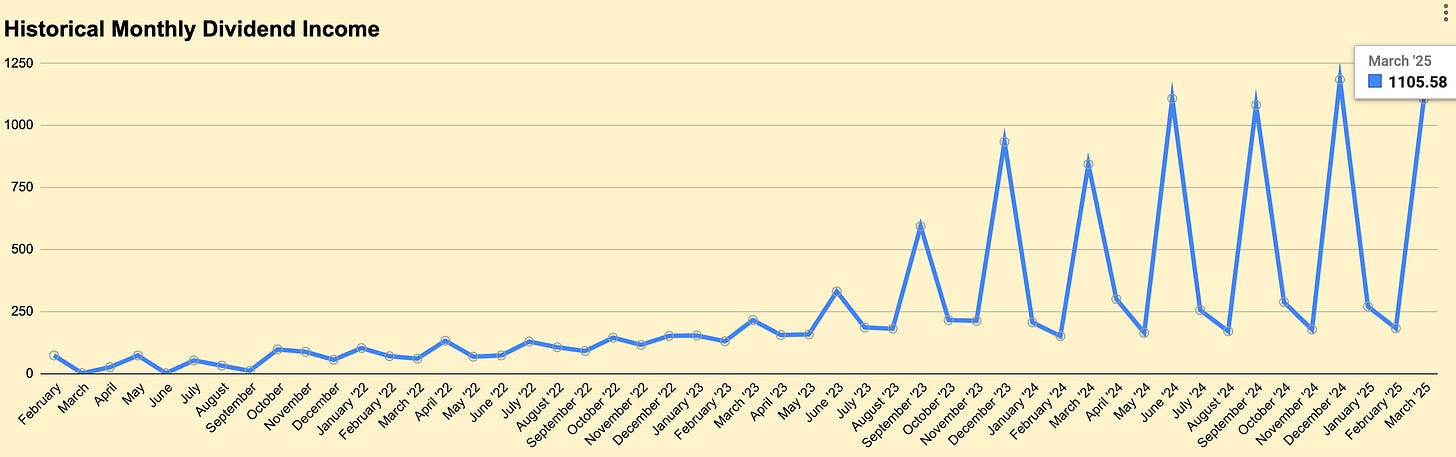

And in the month of March, I made $1,105.58 in dividend income.

Charting out your monthly dividend income is a great way to see the dividend snowball effect taking place.

Buy and Sells

The long term goal of my portfolio is to live off dividend income.

And while high yielding investments obviously pay more in dividends in the short term-

Over the long term, stocks that increase their dividend payouts at a high rate will pay more in dividends.

Therefore, the main focus of my portfolio should be to buy high quality dividend growth stocks.

JEPI is a covered call ETF that I added to my portfolio years ago.

Covered Call ETFs have the potential to be a good way to boost your immediate dividend income.

But the time for covered call ETFs in my portfolio is not now.

I sold JEPI after a total return of almost 22%.

Where did I allocate this capital?

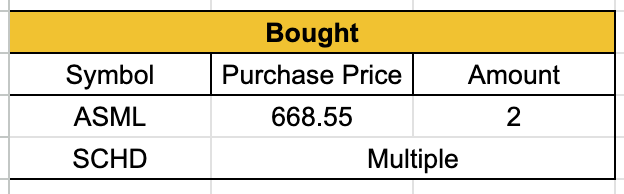

I added more shares of SCHD at multiple prices in the last month, as well as reinvested my over $800 dividend payment from SCHD.

But along with this I bought more shares of ASML, a stock that was added to my portfolio for the first time recently.

This stock is projected to grow earnings at around 20% over the next 3 to 5 years.

Plus, the management team recently stated that they “expect to continue to return significant amounts of cash to our shareholders through growing dividends and share buybacks.”

The buys and sells this month are prioritizing dividend growth over dividend yield.

As you get closer to actually living off dividends, it typically becomes wiser to prioritize dividend yield over dividend growth.

And for now, my priority is dividend growth.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

I agree that fear and sentiment drive the market in the short term and that it will come down to earnings in the longer term. However, we have no idea what impact tariffs will have on earnings. Those companies that look undervalued today are based on pre-tariff assumptions. The fair value of those companies might actually be a lot lower than we think.

Any thoughts?

I'm holding tight. managed to pick up 30 shares of AMZN today at $167.64 each. I know it's not a dividened stock (yet) but I'm trying to add a liitle Growth to my Portfolio. The bulk of the portfolio is Dividend payers. 4 years from hanging up my hat and moving somewhere sunny : )