One of my favorite ways to find investment ideas?

Stealing from Super Investors.

Super investors are investors with over $100M in assets under management.

Every quarter, they are required by law to reveal all of the moves they’ve been making in their portfolio.

These were the top 10 most frequently bought dividend stocks by super investors in Q4 of 2024:

MSFT – Microsoft Corporation 💻🖥️

FERG – Ferguson plc 🏗️🔧

EFX – Equifax Inc. 📊🔐

CVS – CVS Health Corporation 💊🏥

TSM – Taiwan Semiconductor Manufacturing Company Limited 🔬💾

UNH – UnitedHealth Group Incorporated 🏥🩺

SBUX – Starbucks Corporation ☕🌍

LPLA – LPL Financial Holdings Inc. 💰📈

GOOGL – Alphabet Inc. 🔍📡

BAC – Bank of America Corporation 🏦💵

Super investors love quality dividend growth stocks.

If you’ve been subscribed to the newsletter for a while, you should know this.

But here’s what is really interesting.

Many of the stocks on this list have been on the 10 Top Super Investor Buys list for multiple quarters in a row, and some for over a year.

For example, Microsoft was the most frequently bought dividend stock in Q4 of 2024, in Q3 of 2024, and was the 2nd most bought in Q2 of 2024.

Microsoft, CVS, UnitedHealth Group, Starbucks, and Google have all been on this list multiple times in the last year.

Buying Healthcare?

People need healthcare regardless of the economy.

This is why we typically see investors flock to healthcare stocks when fears of a bear market are growing.

Healthcare spending is not tied to economic growth. This makes healthcare stocks less volatile during downturns.

Healthcare stocks also pay consistent dividends.

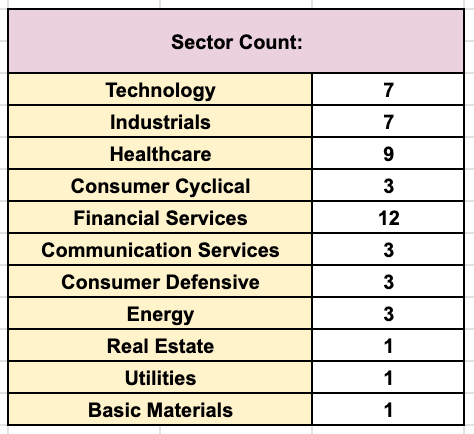

Typically, super investors flock to technology and financial services stocks, and they still did that in the most recent quarter.

But there was a notable increase in the amount of healthcare stocks that were in the Top 50 Most Bought Dividend Stocks list this quarter.

This could indicate that super investors are becoming more defensive.

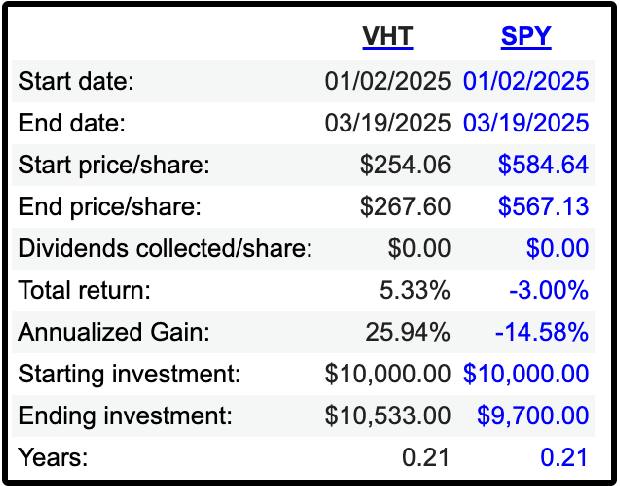

So what have the results been of the increased buying of healthcare stocks?

Vanguard’s healthcare ETF is up 5.33% in 2025, while the S&P 500 ETF is down -3.00%.

A fairly large outperformance for such a short period of time.

There’s a lot of value in looking at what individual super investors are buying and selling.

But there is even more value in conglomerating their buying data, and finding the underlying trends.

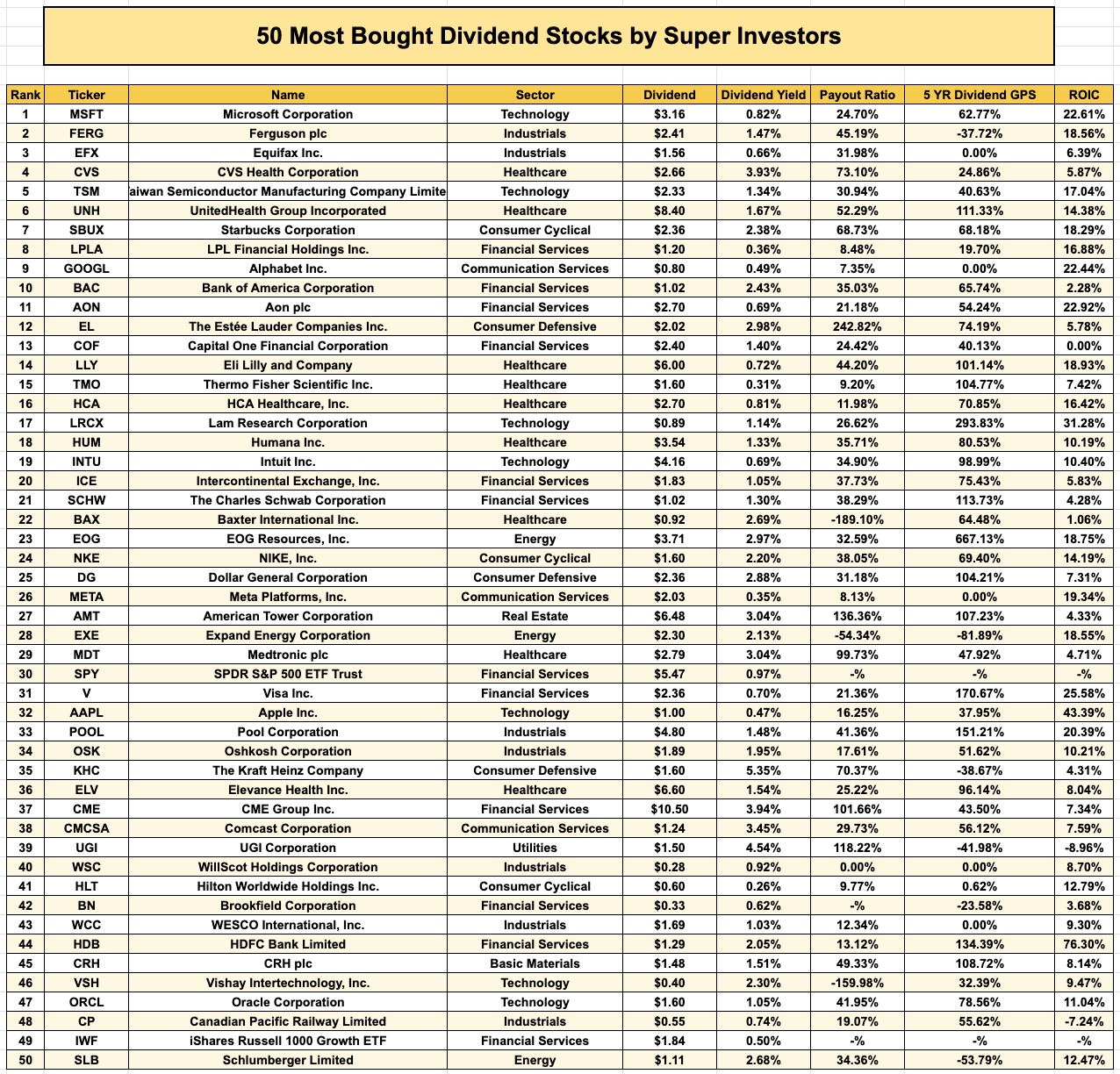

Here is the entire Top 50 list:

You can download this spreadsheet here: Get Spreadsheet

I’m personally excited to see some of my top holdings on this list.

But who knows?

Maybe I’ll steal some more investment ideas from Super Investors in the near future.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

Great stuff, I enjoy your channel! Who were the list of investors you compiled this information from?

Very interesting list of stock. Didn't Buffet sell off alot of his BofA shares or was that before this article? Also I have to say, I loved your Hero image! So funny and creative!