The most passive form of income is dividend income.

Even better?

When that dividend income hits your account every single month.

Naturally, I put together a spreadsheet to analyze every stock I could find that pays monthly dividends.

The Good News: There are a lot of them.

The Bad News: Most aren’t worth buying.

Some have declining share prices.

Some have cut their dividends in the past.

Some just aren't sustainable.

So today, I’m cutting through the noise and showing you 4 monthly dividend stocks I’d actually consider owning.

If you want a free copy of my monthly dividend stocks spreadsheet, click here to grab it.

🏢 1. Realty Income ($O)

Dividend Yield: ~5.6% | Sector: REIT | Dividend Growth: Quarterly

They literally call themselves “The Monthly Dividend Company” (and they’ve earned it.)

656 consecutive monthly dividends

110 consecutive quarterly increases

Member of the Dividend Aristocrats

Realty Income has a payout ratio of ~75% (based on AFFO), and they’ve grown the dividend consistently for over 27 years.

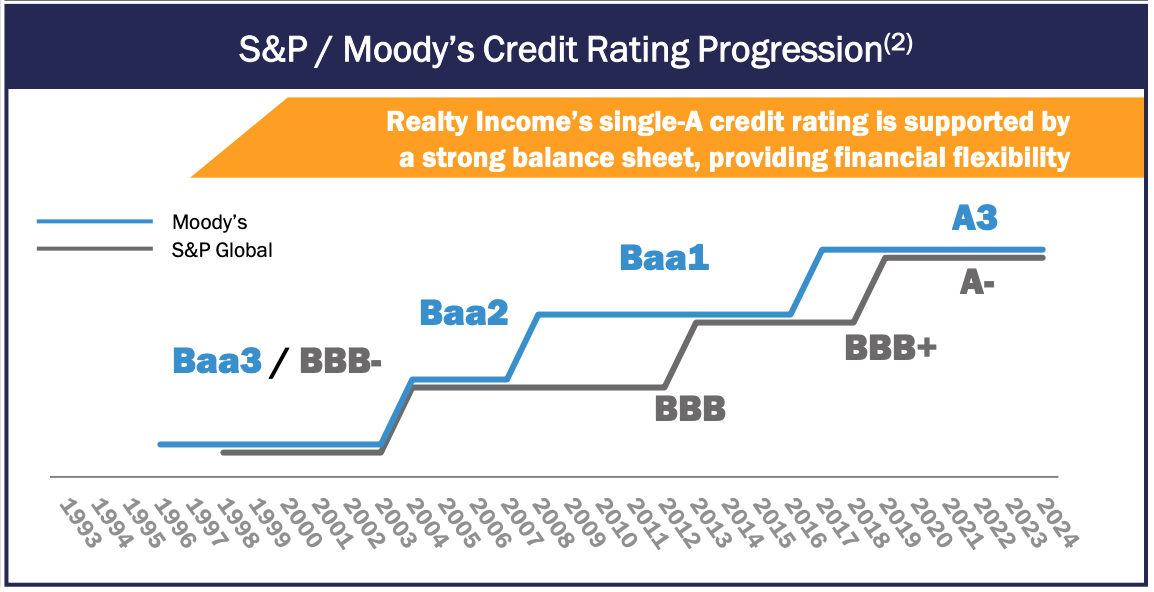

On top of this, credit ratings agencies like Moody’s and S&P Global have consistently increased their credit rating over the years.

As interest rates fall, REITs like Realty Income could benefit from price appreciation, making the total return even more attractive.

📊 According to my dividend discount model, assuming 3.25% dividend growth in the future, Realty Income has a fair value of $62.22. 7% higher than the current price.

🏦 2. Main Street Capital ($MAIN)

Dividend Yield: ~6.7% | Sector: BDC | Bonus: Special Dividends

Main Street Capital is a Business Development Company (BDC), which means they generate income by lending to small and mid-sized private businesses at high interest rates and collecting interest income, fees, and sometimes equity stakes in return.

Pays monthly dividends + frequent special dividends

Never decreased its regular monthly dividend

Many loans are floating-rate, so higher rates = higher income = more special dividends

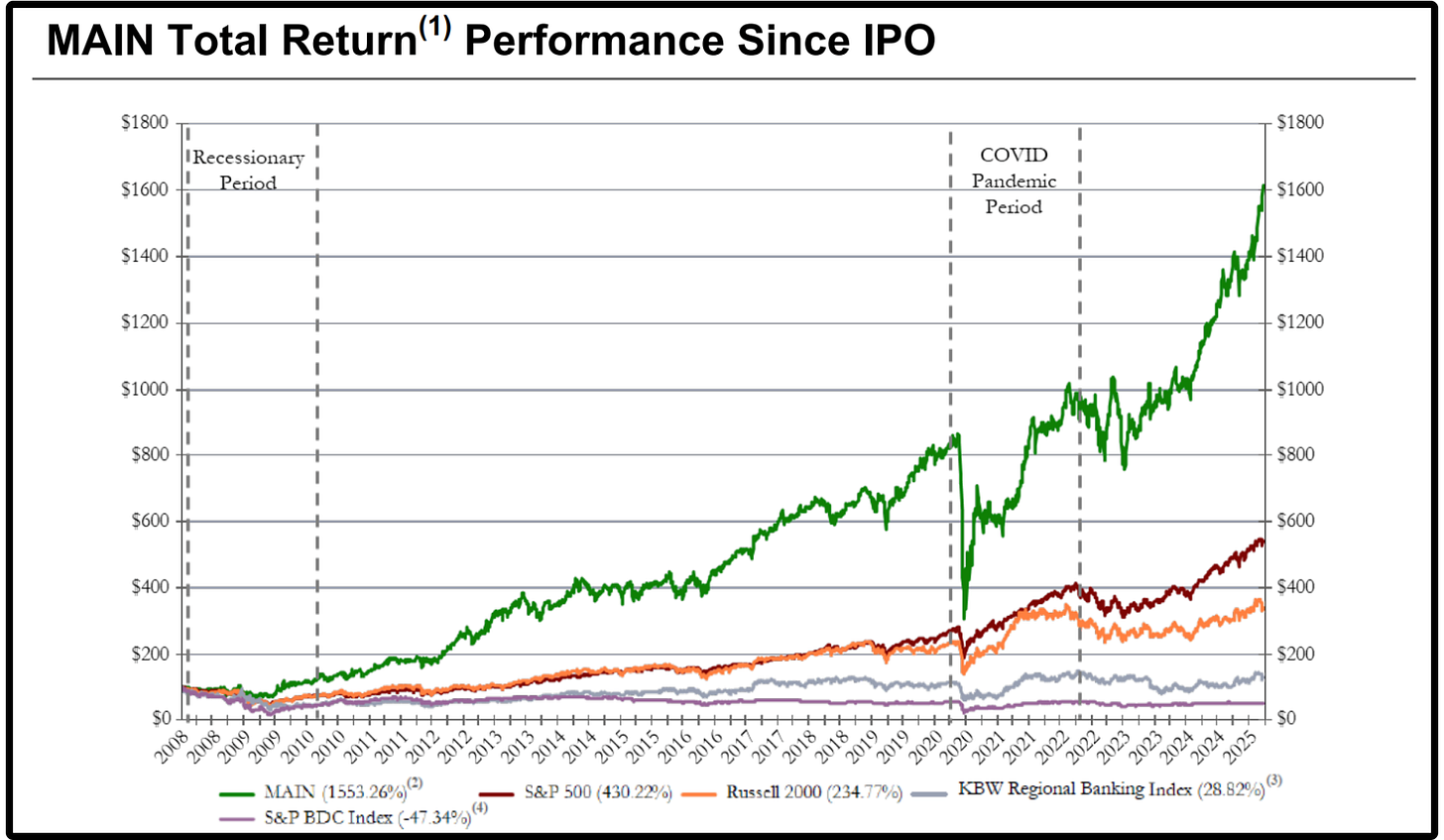

Since their IPO in 2008, they have a total return of 1,553%, vs the S&P BDC index sitting at -47.34%.

Growing NAV (Net Asset Value) is one of the best ways to judge a BDC, and Main Street Capital recently reported they expect record net asset value per share for the eleventh consecutive quarter.

📈 3. SPYI – NEOS S&P 500 High Income ETF

Dividend Yield: ~12% | Strategy: Covered Calls | Tax Efficient Focus

SPYI stands out from the crowd of covered call ETFs:

Smoother dividend payments than peers like $JEPI or $QYLD

Only covers ~80% of its portfolio with calls, allowing for some upside

More tax-efficient than most (thanks to 60/40 capital gains treatment)

I recently made a full breakdown of why I believe SPYI is one of the best covered call ETFs:

🧱 4. Agree Realty ($ADC)

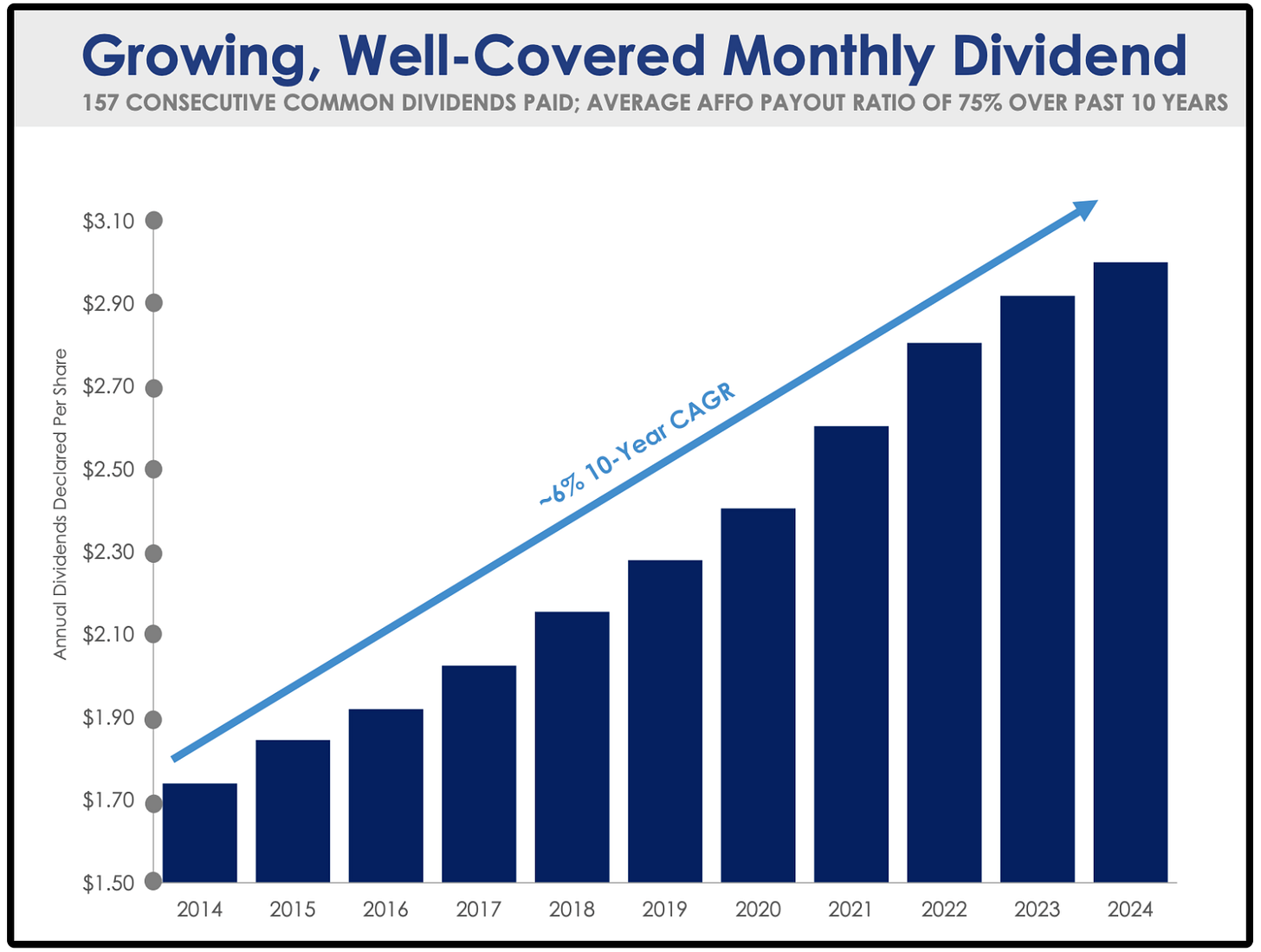

Dividend Yield: ~4.1% | Sector: REIT | Dividend Growth: ~6% CAGR

Often seen as the “little brother” of Realty Income, but don’t overlook it.

154 consecutive monthly dividends

68% of tenants are investment grade (higher than Realty Income)

Top tenants include Walmart, AutoZone, and Tractor Supply

ADC’s dividend growth has been quite impressive for a REIT, with a 5 year dividend growth rate of 5.77%.

Even after a big run-up, the dividend still looks sustainable with an AFFO payout ratio of just 72.5%, and AFFO per share continues to grow faster than most REITs in their sector.

Valuation models show it's fairly valued at current levels. Might not be a screaming buy today, but definitely worth watching.

Note: Short interest for ADC is around 10.52%, certainly higher than I like to see it.

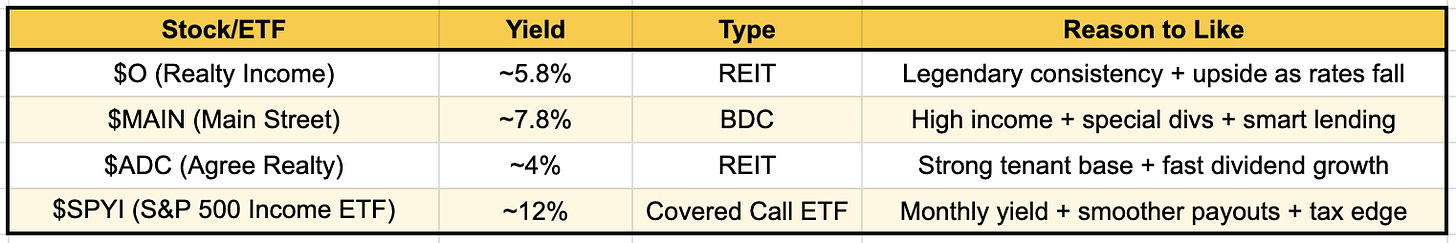

Reviewing The Top 4: 🔥

There are many monthly paying dividend stocks out there, but not all monthly dividend stocks are created equal.

Let’s review our top 4 from today:

Each has its own unique advantages, whether you're looking for long-term reliability, high monthly income, dividend growth potential, or tax-efficient cash flow.

Check out these resources:

Tickerdata 🚀 (1 WEEK TARIFF SALE: Use code: “TARIFF” at checkout for 30% off!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

What are your thoughts on Vici?

What are you thoughts on schd?? I like it here.