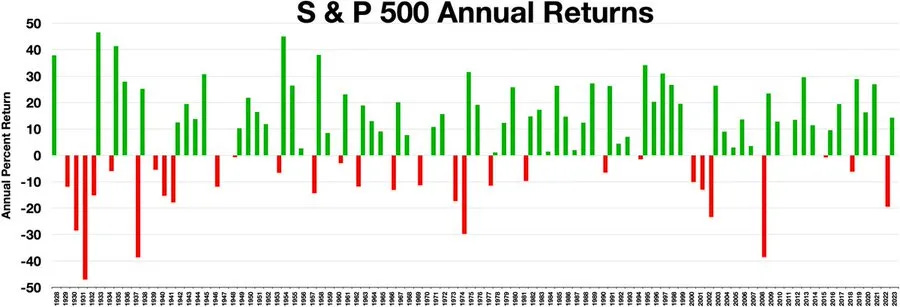

The past month has been volatile. Very volatile.

But this is nothing new for Mr. Market.

Mr. Market has been volatile for centuries.

We always hear about how the average market return is around 8% - 9% (more like 7% adjusted for inflation).

But the average is not usually what happens.

Mr. Market Returns 🧔♂️

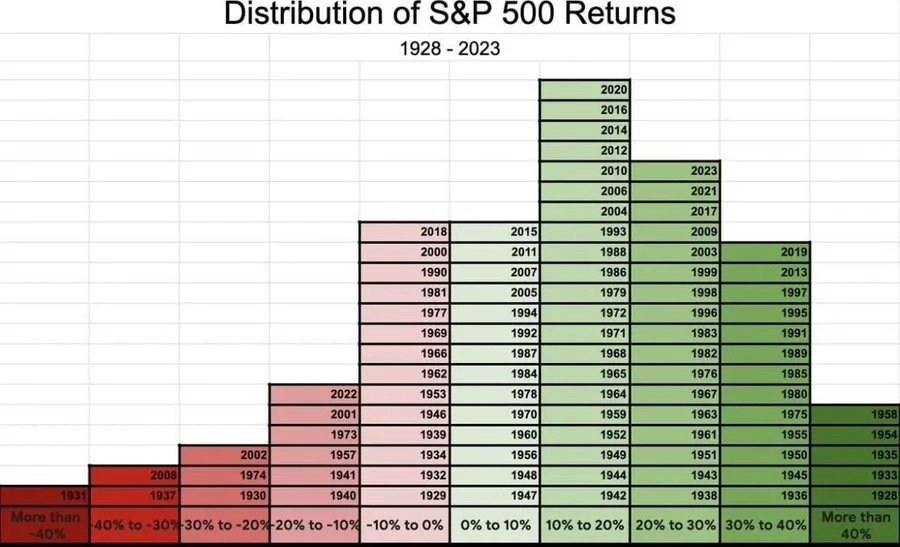

If we look at the distribution of the S&P 500 returns over the last 95 years, we can see it is just as common for the market to return -10% to 0%, as it is to return 0% to 10%.

Basically, like mentioned above, the market is very volatile.

It always has been.

But this can be a major risk for the average investor.

Why?

Because it exposes you to what is known as sequence risk.

Sequence Risk & The 4% Rule 🚫

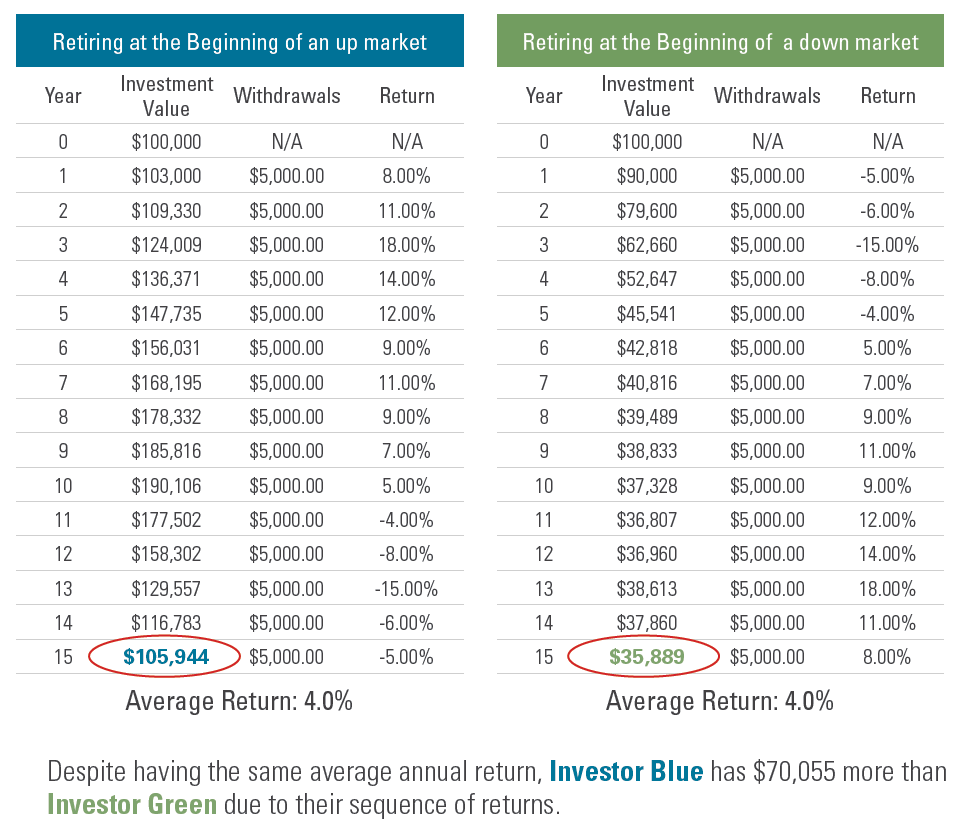

The 4% rule is a popular retirement strategy that suggests retirees can safely withdraw 4% of their portfolio in the first year and then adjust for inflation annually.

This approach aims to make savings last for 30 years.

Sounds simple, right?

Well, there’s a catch: sequence risk.

Sequence risk refers to the danger of experiencing poor investment returns early in retirement, when an investor is making withdrawals.

Look at the example pictured below.

In the above example, both investors started with $100,000, and had an average annual return of 4% over a 15 year time period.

But here is what each finished with:

Investor 1: $105,944

Investor 2: $35,889

Why such a difference?

Because the sequence of returns you get plays a major role in the potential longevity of your portfolio.

But if you're anything like me…

The thought of the quality of your retirement—or even the ability to retire at all—being dictated by market performance right before or just after you retire is not acceptable.

Fortunately, there is a solution that fixes this.

Dividend Growth Investing 🚀

Instead of relying on market fluctuations and selling assets to fund retirement-

Dividend growth investing focuses on building a portfolio of high-quality, dividend-paying stocks that consistently increase their payouts over time.

This creates a steady, growing income stream—one that isn’t dependent on whether the market is up or down when you retire.

The benefits of this strategy are massive:

📉 Eliminates sequence risk – No need to worry about withdrawing from a declining portfolio.

💰 You never have to sell stocks – Your investments keep working for you, compounding over time.

📊 Your income grows every year – Thanks to dividend increases, your purchasing power rises even in retirement.

🔥 Built-in inflation hedge – Companies raising dividends often outpace inflation, protecting your income.

🧘 Peace of mind – Instead of stressing over market volatility, you can focus on enjoying retirement. (And your growing income)

The market is unpredictable.

But you dividend income doesn’t have to be.

My personal portfolio has fluctuated up and down in the last few months.

But my dividend income has only grown.

This is the beauty of dividend growth investing.

Check out these resources:

Tickerdata 🚀 (My automated spreadsheets and instant stock data for Google Sheets!)

Interactive Brokers 💰 (My favorite place to buy and sell stocks all around the world!)

Seeking Alpha 🔥 (My favorite investment research platform!)

The Dividend Report 📊 (Free Newsletter for Straightforward Dividend Stock News)

Other News:

At the start of every month, I send out a newsletter to my paid newsletter subscribers with a list/spreadsheet of all the dividend stocks that I believe to be currently undervalued.

If you’d like to receive this sheet, you can sign up here:

That’s all for now!

See you next week!

Dividendology 🚀

My thoughts exactly, I share the same sentiment. Also, Dividend Growth Investing is a fully automated way to retire, the 4% rule is not as you may have to adjust withdrawal rates depending on the market, inadvertently creating your own sequence risk on top of the already existing sequence risk.

The 4% Rule has always felt like a game of chance to me. This is a great explanation of why it’s not a reliable retirement plan - at least not for me. Dividend growth investing is a long process but hopefully it will provide a long runway of wealth to pass down to my kids!